When you use Medicare for your health insurance, you may be burdened by some out-of-pocket costs in addition to your monthly Part B premiums. Aside from the basic benefits that come with Medicare Parts A and B (Original Medicare), you can also seek further coverage with a Medicare Supplement plan.

These plans will cover many of your out-of-pocket costs. As such, Medigap policies don’t offer traditional Medicare benefits or coverage of healthcare costs. Instead, they supplement your Medicare coverage with additional benefits that can help you pay less out-of-pocket. In addition to this, some Medigap plans also provide a few extra points of coverage, like your first 3 pints of blood, and coverage for foreign travel emergencies.

- Honorable Mention: AFLAC

- How to Choose the Best Medigap Company

- What Are The Best Medicare Supplement Plans For 2024?

- Medicare Supplement Comparision Chart For 2024

- Most Coverage Pre 2024: Medicare Supplement Plan F

- Most Comprehensive For New Enrollees: Plan G

- Best High Deductible Option: High Deductible Plan G

- Medicare Supplement Plan D: The Best Plan G Alternative

- Best Plan For Affordable Coverage: Plan N

- Medicare Advantage vs. Medigap

- Final Thoughts on Medigap Plans

Medigap is offered by many private insurance companies. Below is a list of a handful of insurance companies we work with.

Aetna is a big provider that offers coverage throughout the country. Their plans all come with a 30 day free look period, as well as a household discount. Aetna offers coverage for most states.

Cigna is another one of the largest providers out there, so you’ll likely come across their plans on the market. When you use a Medigap plan by Cigna, you’ll be covered by either ARLIC, Loyal American, or Cigna Health and Life, which are all subsidiaries of Cigna.

Mutual of Omaha or one of its affiliates offers plans in all 50 states. These plans may offer a household discount, the ability to see any doctor that accepts Medicare, and no policy fees. Mutual of Omaha applications are easy to do online, and they’ll send you a temporary ID card via e-mail after you enroll. To learn more or apply now click here.

Medigap Plans by UnitedHealthcare® are available in most states. There is a variety of plans to choose from depending on your coverage needs.

Anthem plans are offered in 14 different states. These plans come with a household discount, automatic payment options, and year in advance payment.

Blue Cross Blue Shield offers plans F, N, and G throughout most of the country. These plans come with a household discount as well as provider options. They also offer portable coverage, so you can use these plans anywhere that accepts Medicare.

Manhattan Life offers Plans A, C, F, G, and N in over 35 states. These plans come with a household discount of up to 7%. They are very competitive in many areas across the country and are a top choice for your supplement plan.

Humana offers many different plans, including Plan K, L, N, F, C, B, and A. They operate in all 50 states, but that doesn’t guarantee that each of these plans will be available everywhere.

Medico offers Medigap plans in many states. With Medico, you’ll be able to use your plan with any doctor that accepts Medicare. A household discount is offered where available.

ACE Proprety and Casualty (CHUBB) offers Medigap plans in over 30 states. They offer a wide variety of plans, but you’ll need to check to see if a given plan is available in your state. They offer a household discount as well.

New Era Life offers Medigap plans under a few subsidiaries. These are the New Era Life Insurance Company, Philadelphia American Life Insurance Company, and New Era Life Insurance Company of the Midwest. They offer portable coverage, so you can use your coverage with any doctor that accepts Medicare.

Allstate Health Solutions offered Medigap plans in many states. They offer portable coverage, a 30-day free look period, in the states where they operate.

Honorable Mention: AFLAC

AFLAC has been very competitive across the country for Medigap plan in 2023. We expect them to remain competitive through 2024 and beyond. They offer a 12 month rate lock, portable coverage and easy to use customer service.

How to Choose the Best Medigap Company

When it comes to comparing Medicare Supplement insurance plans, the main relevant factors are price and carrier stability. Because plan coverage is standardized, you won’t have to worry about less coverage with one company over another. Thus, the things to focus on are how cheap your coverage is, and how stable it’s likely to be over time.

What Are The Best Medicare Supplement Plans For 2024?

All Medigap plan options are completely standardized throughout the country. This means that Aetna Plan G and Cigna Plan G will offer the exact same coverage. However, not all companies offer the same plans in each state. In addition to this, some plans are no longer available for people who became eligible for Medicare past a specific date, such as Plans F and C.

When you enroll in Medicare Part B, you’ll enter your Medigap open enrollment period. Medigap plans can usually choose to not sell you a plan based on your pre-existing conditions. However, if you choose a plan during this period, they must sell it to you, regardless of your health.

For now, every Medigap plan is still available to people who became eligible before 2020. Still, it’s always good to make sure you understand your coverage options before you shop around.

Have Medicare questions? Our licensed agents are ready to help! Call us at 800-208-4974 today!

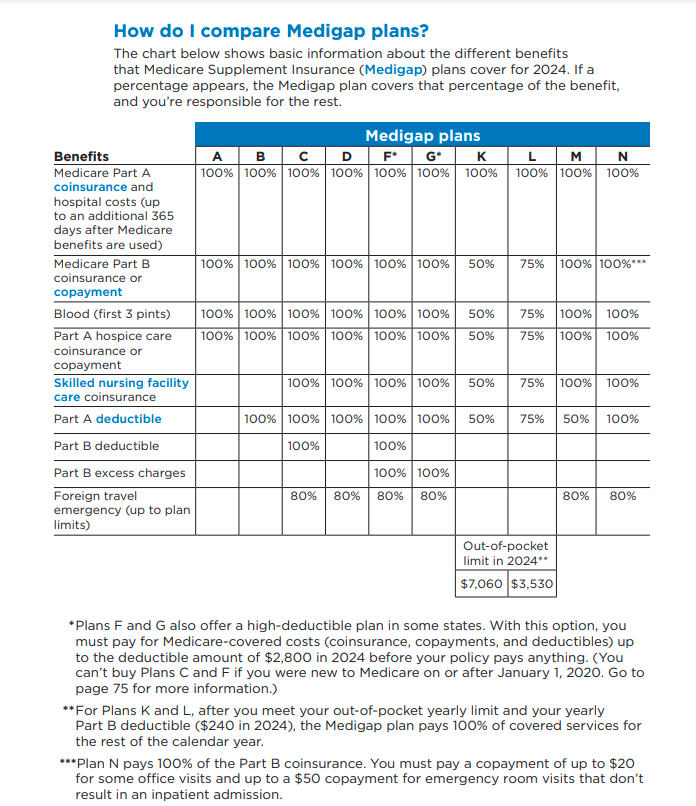

Medicare Supplement Comparision Chart For 2024

The Medigap plans that are currently available are Plans A, B, C, D, F, G, K, L, M, and N. Plan A offers the least coverage, and Plan F provides the most. Plans G, K, L, and M cover less than Plan F. These plans cover different categories and amounts than plans A, B, C, and D.

Coverage options will vary a lot because there are so many plans. However, many plans overlap. For example, Part A is the only plan that doesn’t cover the Part A deductible. Similarly, every plan covers at least some of the Part B coinsurance and Part A hospice care coinsurance, although Plan L and Plan K don’t cover it entirely. As of 2024, only Plan F covers the Medicare Part B deductible.

Take a look at this chart for a more comprehensive comparison of what each plan covers.

Most Coverage Pre 2024: Medicare Supplement Plan F

Plan F is notable as being the Medigap plan that offers the most coverage. Plan F covers every single fee category that Medigap plans can cover, including all Original Medicare deductibles and coinsurance payments, as well as Part B excess charges. Because Plan F was very popular, it was offered by most companies that offered Medigap plans. This further lowered the price, making Plan F even more desirable.

However, there are some new restrictions on Plan F. If you turned 65 or are enrolled in Medicare Part A after January 1st, 2020, you won’t be able to purchase Plan F. Aside from Plan C, Plan F is the only Medigap plan that covers the Part B deductible.

Agent Tip

Plans F and C are no longer available to folks who turned 65 or started Medicare Part A AFTER January 1st, 2020.

If you already have Plan F or are eligible to buy it, it will still be available to you with no restrictions. These new restrictions apply only to those who turned 65 or enrolled in Medicare Part A after the start of 2020. So, even if you’ve had Medicare for years and are just getting a Medigap plan now, you’ll still be able to buy Plan F.

Who is F Best For?

Most people who want comprehensive coverage and are eligible should seek out a Plan F plan. Plan F is offered by many insurance companies, so you can usually find a reasonable price no matter where you are.

Call us at 800-208-4974 to compare rates on Plan F today!

Most Comprehensive For New Enrollees: Plan G

Plan G is the most comprehensive plan aside from Plan F. The only difference between these plans is that Plan G doesn’t cover the Part B deductible, which comes out to only $240 per year. For this reason, Plan G is expected to become the new most popular plan, as Plan F is slowly phased out.

In a practical sense, Plan G is unlikely to differ from Plan F in any significant way. Because the Part B deductible is so low, the overall financial impact of these plans should be very similar for most. Because Plan G is growing in popularity, more companies will likely offer it as time goes on. As this happens, the price will go down, making Plan G even more affordable.

Who is Plan G Best Suited For?

Plan G will work best for people who want comprehensive coverage but aren’t eligible for Plan F. It’s still the case that most people who qualify for Plan F should seek it out, but otherwise, Plan G is a good choice as well. So, if you’re not eligible for Plan F, don’t worry too much — Plan G will serve you just fine.

Best High Deductible Option: High Deductible Plan G

High deductible Medigap plans are just what they sound like. These plans have higher deductibles, but that translates to lower premiums. High Deductible Plan G will have a yearly deductible of $2,800.

These plans aren’t offered by every company that offers regular Plan G, so it’s important to check to ensure that you’ll have access to it. Many people who don’t expect to use as much of their Medigap coverage find high deductible plans useful since the premiums can be very low.

Agent Tip

Aside from Plan G, Plan F is the only plan that has a high deductible version available.

When To Choose This Plan?

You should go for High Deductible Plan G if you mostly want your coverage for significant medical expenses, rather than regular use. The premiums for these high deductible plans can be as low as $30 per month, and rarely get higher than $60. If you don’t think you’ll need as much coverage, this can be a great way to make sure that you have some, while still saving money.

Yes, but only to those who turned 65 or started Medicare Part A before January 1st, 2020.

Yes, Plan G will be available in 2024 to anyone who is eligible to purchase Medigap plans.

Medicare Supplement Plan D: The Best Plan G Alternative

Plan D is another plan that may look appealing to you based on our chart above. Plan D is just like Plan G but doesn’t cover Part B excess charges. Excess charges occur when a doctor charges more than the accepted Medicare rate. These charges can vary each year, unlike something like a deductible that comes to the same amount each year, no matter what you do.

Read More: Medicare Supplement Plan D

When to Choose Plan D?

For most people, Plan D won’t provide many additional savings, even though there is less coverage. This is because Plan D isn’t as popular, which means that fewer insurance companies offer it. For this reason, Plan D tends to cost more relative to its coverage, compared to plans like Plan G, Plan F, and Plan N.

Best Plan For Affordable Coverage: Plan N

Medicare Supplement Plan N is another rising plan on the scene. Compared to other plans, Plan N actually covers the same things that Plan D does. This offers you full coverage for everything aside from the Part B deductible and Part B excess charges, as well as 80% of your foreign travel expenses.

Although Plan N covers the same things as Plan D, the difference lies in its payment structure. Plan N has its own copayment structure, which is unique among Medigap plans. Plan N copayments will vary but tend to be around $20 for doctor visits and up to $50 for emergency room visits.

These copayments, in addition to the increased popularity, mean that Plan N tends to be cheaper than Plan D. Until Plan D becomes more popular and therefore cheaper, Plan N remains a better option for most people.

When Should I Choose Plan N?

Plan N is suitable for people who want an affordable premium, and are okay with paying small copays. These will usually come out to $20, with premiums tending to hover around $100 per month. Depending on your area and pricing structure, this could vary, so always make sure to double-check. However, if this is what you’re after, Plan N is a good choice for you, as premiums will be lower than they are for Plan D.

Have questions? Call us at 800-208-4974, our licensed agents are ready to help!

Medicare Advantage vs. Medigap

If you’re using a Medigap plan, you won’t be able to purchase a Medicare Advantage (Part C) plan as well. This is because Medigap covers fees associated with Original Medicare, and you can’t have Original Medicare and Medicare Advantage at the same time. So, you’ve got to choose: Original Medicare + Medigap or Medicare Advantage.

Because Medicare Advantage plans vary so much, this can be a very difficult choice for many people. If your concerns are primarily financial, then there’s no substitute for researching costs and finding quotes, since prices will vary for everybody depending on location and other factors.

Final Thoughts on Medigap Plans

If you’re going to get a Medigap plan, don’t skimp on the research. It’s imperative to find a plan that’s perfect for you, so make sure that you know what your options are and what to look for. In general, most people will be best served by one of Plan F, Plan G, Plan N, or Plan D, so look at these plans first and foremost. Make sure to compare prices and make sure that you want to go with Medigap rather than Medicare Advantage before you commit.

If you want more help finding a plan, feel free to reach out to us. We’re independent of any insurance provider, so our focus is always on finding a plan that works best for you. We’re experienced in dealing with all major Medigap and Medicare Advantage plan providers. That expertise translates into finding the best Medicare plan for your needs.

We at Bluewave Insurance work with both Medigap and Medicare Advantage plans. If you are insure of what plan to choose or just have general questions, call us at 800-208-4974 today!

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.