Medicare Supplement insurance plans cover fees that Medicare doesn’t. Many people refer to these plans as “Medigap Plans”. The basic idea behind these plans is to cover expenses like copays, coinsurance, and deductibles that you usually have to pay even when you have Medicare coverage. Plan D is one popular Medigap plan we will explore in detail here.

There are 10 different Medigap plans in total, labeled by the letters A through N. Some plans like A and B cover less. In contrast, plans like G, N, and F cover almost all of the costs that Original Medicare does not pick up. In general, the more coverage you have, the higher your monthly plan premium will be.

What is Medicare Supplement Plan D?

Now, let’s look at Plan D in particular. It is essential to note here, Plan D is not the same as Part D. Part D deals with prescription drug coverage, and has nothing to do with Medigap policies. Medigap Plan D and Part D have no relation to one another.

Agent Tip

Medicare Part D covers prescriptions and Medicare Supplement (aka Medigap) Plan D helps pay for the 20% that Medicare does not cover.

Continue Reading: Medicare Part D (RX Plans)

What Does Plan D Cover?

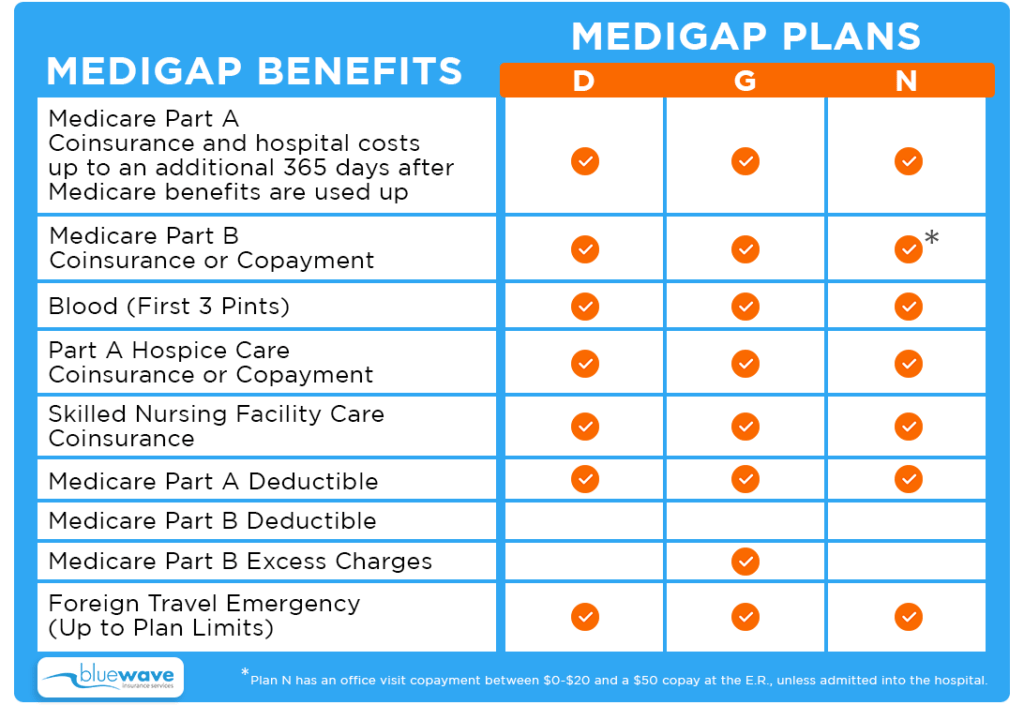

No matter which insurance company you purchase it from, Medigap Plan D will cover the same things. These things are:

- Part A Coinsurance and hospital fees

- Medicare Part A hospice care coinsurance or copayment

- Medicare Part A deductible

- Part B coinsurance or copayment

- First, three pints of blood drawn for a procedure

- Skilled Nursing Facility coinsurance

- 80% of foreign travel emergency medical costs

This means that if you have a fee in any one of these categories and pay your Plan D monthly premiums, your fee will be covered by your Medigap Plan D.

What Isn’t Covered?

Medigap Plan D does not cover:

- Part B deductible ($240 in 2024)

- Part B excess charges

Excess charges are fees that you will incur if your provider does not accept Medicare Assignment and charges more than Medicare allows.

Because Medigap Plan D has these gaps in coverage, you could look at another plan if you expect these fees to be high for you. Otherwise, Plan D offers comprehensive coverage.

There is a simple way to figure out if Plan D is better for you than a plan that covers the Part B deductible. The Part B deductible is $240, and almost everybody will meet it each year. If the other plan you are considering costs more than $240 per year (or $16.50 per month) more than Plan D, then it is not worth it. The reason is that you will end up paying more for this plan than you will to just pay the Part D deductible directly.

Plan D vs. Plan G: Which is Better?

There is only one difference between Plan D and Plan G: excess charges. Determining which plan is better for you essentially comes down if you want coverage for Part B Excess Charges. If your regular physician visits might result in excess charges, then Plan G will be worthwhile to examine.

Read More: Medicare Supplement Plan G

Is Plan D Better Then Plan N?

The difference between Plan D and Plan N is slightly harder to explain. Both of these plans cover payments in the same categories, and the difference has to do with how they cover the Part B coinsurance and copayment.

Plan D will cover these fees in their entirety. Plan N, on the other hand, requires a $20 copay for doctor visits, and a $50 copay for emergency room visits. If you think that you will save more money due to a lower premium, even though you’ll have these fees added on, then Plan N may be the better plan for you.

Continue Reading: Medigap Plan G vs N

How Much Does It Cost?

Because Medicare Supplement plans are offered by private insurance companies, there is no standard price throughout the country. The cost of these plans will depend on various factors, including your age, health condition, and more. As with all supplement plans, it is important to compare plans from multiple insurance providers to ensure that you are getting a deal that works for you.

Even though we can’t say how much Plan D will cost for you, we can still look at monthly averages for Plan D. For most people, the premium for Plan D will be somewhere between $100 and $200. Remember to check your local rates, since plan pricing could vary from this average in your area.

When Should I Get Medigap Plan D?

The best time to buy a Medigap plan, including Plan D, is during your Medigap Open Enrollment Period. This is a six month period that begins as soon as you are 65 and enrolled in Medicare Part B. During this time, you will have more plan choices, and it will be easier to find a plan at a good price.

During your Medigap Open Enrollment period, you will be able to purchase a plan even if you have underlying health problems. This doesn’t hold for these plans at other times, so it is important to buy a plan during this period if you do have underlying health issues.

What If I Buy A Plan Outside of Open Enrollment?

Medicare Supplement plans may be subject to medical underwriting. This means that depending on your health condition, you may be unable to access a plan. During Medigap Open Enrollment, these concerns won’t be relevant for you. If you choose to wait until after Open Enrollment to purchase a plan, there is no guarantee that the plan will be available for you.

Which Insurance Companies Sell Plan D?

Plan D is not offered by every insurance company that sells Medigap plans. In fact, you’ll find that Plan D is one of the plans that insurance companies sell the least often. Feel free to review our insurance carrier reviews if you are still researching companies.

If you are interested in comparing prices and carriers give us a call at 800-208-4974.

How To Find A Plan

If you think that a Medigap Plan D might work for you, then it’s always good to start looking at plans now. If you need help finding the right plan, feel free to call us at 800-208-4974 for help.