At Bluewave Insurance we are glad to provide our clients with the best Medicare supplement plans. We are proud to present GPM Life Medicare plans. To learn more or to sign up, give us a call at 800-208-4974.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

GPM Life Company Overview & History

Government Personnel Mutual Life Insurance Company or otherwise known simply as GPM Life was founded in 1934. This was when the United States found itself between the two major world wars, and WWI had left a lot of families devastated.

It was then that Peter J. Hennessey, a retired Army Colonel realized that all the life insurance policies during that time seemed to exclude paying kind of benefits if the one insured had been killed during an act of war.

Those who thought they were doing the right thing by buying life insurance then found themselves without any benefits if they had a loved one killed during WWI.

Peter Hennessey then went around to various insurance companies with his idea of getting rid of this war exclusion. None of them agreed with him that this was important. This helped him decide to start up a new type of insurance company and one that would provide insurance protection even if someone died during a war.

So, in 1934, he founded Government Personnel Mutual Life Insurance Company, which became the first to serve the needs of military personnel and their families.

Just four short years later, Colonel Hennessey died very unexpectedly, and his wife Blanche Hennessey was elected to be the president of the company.

This was yet another first in insurance history, a woman leading a commercial insurance company. Over the past 80 years, GPM has expanded its market to include all Federal employees, families, individuals, and seniors. Their services and products are unique, and each is specially designed for all these different markets.

Government Personnel Mutual Life Insurance (GPM) Company Ratings

GPM Life Insurance company has been given an A- or Excellent rating by A.M Best’s opinion in the company’s excellent ability always to meet their ongoing insurance obligations for their clients.

This latest rating was given to them in February of 2019. These ratings have been provided by A.M. Best on Government Personnel Mutual Life Insurance Company since 1954.

GPM Health Insurance Stability and Strength

Ever since GPM Life was founded in 1934, they have operated under a consistent philosophy, and that is to maintain a long-term view of things. This means the company is managed in a way that ensures it will be viable and relevant today and in the future.

They are an insurance company that is recognized all over the country as a mutual company that is owned by its policyholders. They don’t report to nor do they share the profits with the shareholders.

It’s the policyholders who share in the profits through their policy dividends and they also elect who is on the Board of Directors and they are the ones that oversee managing the company.

This means that GPM Life is totally accountable to their customers and the strength of their financial statements shows their commitment to this cause.

GPM Financial Statement

The most current financial statement released is from December 31, 2015, and this is what was reported to the public and their policyholders:

- Invested Assets – $804,687,481

- Total Assets – $836,118,071

- Total Liabilities – $719,940,136

- Surplus – $116,177,935

- 2015 Net Income – $2,562,002

- 2015 Net Increase in Surplus – $3,798,141

GPM Life Insurance Products and Services Offered

GPM Life has always been committed to providing top quality products and services to its policyholders. Their mission is to continue to be a company owned by and operated for the total benefit of their policyholders. They serve individuals, families, government personnel, seniors, and the military, and their services include:

- Life insurance

- Final Expense

- Annuities

- Medicare supplements

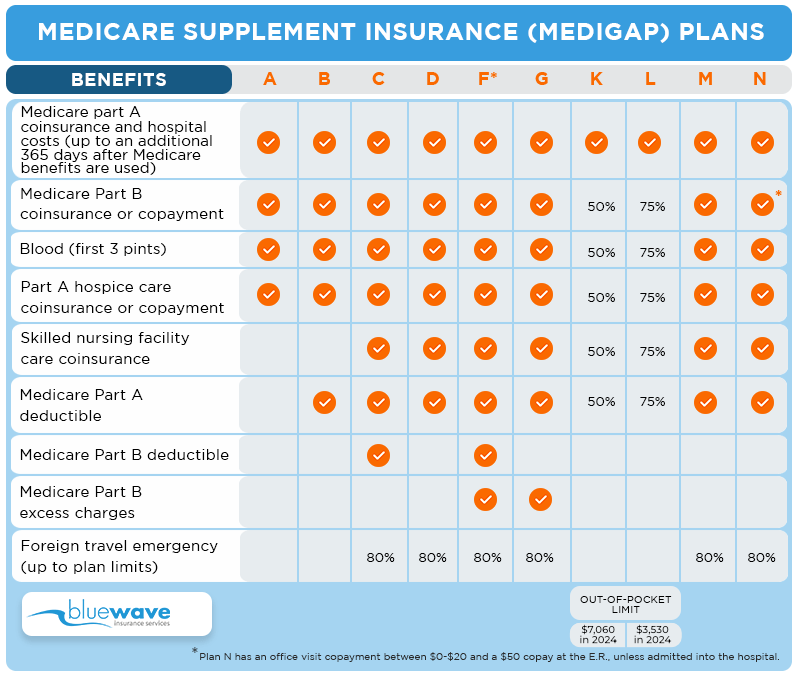

GPM Medicare Supplements Plans Benefits and Coverage

It’s important to GPM Life that their policyholders understand Medicare and the maze that exists to try to get through in order to get the right coverage.

They provide important information to help educate folks on the ins and outs of Medicare and Medicare Supplement insurance. Here is a little about Plans F, G, and N that GPM Life offers to its policyholders.

Plans F and G are the most popular plans currently. As you can see in the chart above, Plan F covers 100% of all costs that Medicare does not pay in full.

Plan G is identical to Plan F, the only difference is that the annual Part B deductible is not covered. In 2024 this deductible is $240 for the year. Overall Plan G is a much better option vs Plan F.

As for Plan N, it covers the basics covered with F and G however, it does not cover Part B deductible or Part B excess charges. Also, there is a copay of $0-$20 per office visit with this plan.

Plan N is the least expensive supplement plan of the three. You can read more about Plan N here.

Yes! With GPM Life Medicare supplements they offer a 7% household discount in states where it is available.

GPM Medicare Supplement Costs

The cost of GPM Medigap plans vary state by state and also by the customized coverage you want. We recommend that you speak with a licensed professional, so you get the best rate for your unique needs. Here’s a quick look at GPM Medicare supplements’ cost for a 65-year-old female nonsmoker; rates are quoted per month.

| Location | Plan F | Plan G | Plan N |

| Philadelphia, PA | $188.89 | $140.43 | $100.23 |

| Phoenix, AZ | $207.17 | $141.56 | $96.55 |

| Richmond, VA | $142.64 | $98.3 | $72.83 |

Compare Plans Online

Receive a Free Quote Instantly!

GPM Medigap Plan F

GPM makes signing up and getting Medicare benefits simple and easy. With their Medicare supplement Plan F, you get full coverage from the “gaps” that Original Medicare doesn’t cover. Also, you pay $0 for cost-sharing. The only thing you’ll have to pay for is the monthly premiums, which vary state by state.

With Medicare supplement Plan F you get full coverage for:

- Part A deductibles

- Part B deductible

- Part B coinsurance

- Excess charges

- Skilled nursing facility

Plan F covers much more, including foreign travel emergencies, durable equipment, and other benefits. This plan is perfect for folks that frequent the doctor’s office or need more medical attention. Plan F will have you fully covered if anything unexpected occurs.

GPM Medicare Supplement Plan G

As mentioned before Plan G is identical to Plan F, the only thing is that you have to pay for the Part B deductible. Plan G is also a great alternative if you want a lower monthly premium.

Here are some coverage highlights of Plan G:

- No copayments

- Coverage for Part B deductible

- Coverage for Excess Charges

Medicare supplement Plan G allows folks to visit any doctor or hospital they want that accepts Medicare, with no network restrictions whatsoever. Plan G also covers copays, so you don’t have to pay out-of-pocket for doctor’s visits. This plan is great for folks that want comprehensive coverage but don’t want to pay the Plan F monthly premium price.

GPM Medicare Supplemental Plan N

Medigap Plan N is one of the most affordable plans that GPM has available. With this plan, you’ll get the same basic benefits you get with Plan G except for added copays (up to $20 per visit) and no coverage for the Part B deductible and Part B Excess Charges.

With Plan N you’ll be able to get a great plan with an affordable monthly premium that can save you money in the long-run.

Learn more: Medicare Supplement Plan N

Our Recommendation

GPM Life is an established insurance company with a strong, stable history. We do recommend them in markets where they are competitive on price.

Before applying for a plan be sure you have compared rates from all the carriers in your area to be sure you are not overpaying.

thumb

If you’re wondering if GPM Life is for you, call us directly at (800) 208-4974 for a free quote comparison today!

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.