At Bluewave Insurance we are happy to provide our clients with Americo Medicare Supplement plans. To learn more about their comprehensive plans and to receive a free quote comparison, contact one of our trusted insurance agents at 800-208-4974.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

Company History and Background

Formerly known as The College Life Insurance Company, Americo Financial Life and Annuity Insurance Company is one of the biggest privately-owned insurance companies in the United States. Operating from Kansas City, Americo offers a variety of life insurance products, mortgage protection, annuities, and Medicare supplement insurance.

The Americo family includes the following subsidiaries:

- Great Southern Life Insurance Company

- National Farmers Union Life Insurance Company

- United Fidelity Life Insurance Company

- Investors Life Insurance Company of North America

- National Farmers Union Life Insurance Company

Customers can purchase any of Americo Financial Life insurance products through over 350 independent insurance agents in 38 states across the United States.

Value Strength and Ratings

Americo Life Inc. has been in business for over 100 years, making it one of the oldest in the insurance industry. The company has more than $6 billion in assets, over 650,000 policies under administration, and more than $32.7 billion of life insurance in force. Due to its balance sheet strength, claims-paying ability and overall credibility, Americo earned an “A” (Excellent) from the independent evaluator, A.M. Best and an A+ rating with the Better Business Bureau (BBB).

Americo Medicare Supplemental Insurance Benefits

When Medicare policies fall short and fail to cover certain medical costs, Medicare Supplemental Insurance comes to rescue. Therefore, it is always wise to get a reliable Medicare supplement insurance plan to cover healthcare expenses such as deductibles, copays and coinsurance.

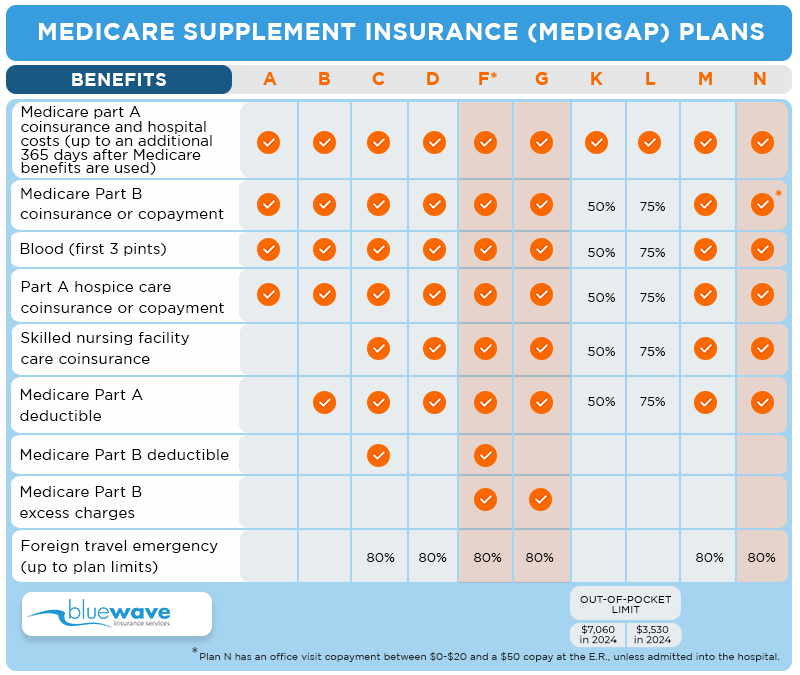

Customers who already have basic Medicare plan A and plan B are eligible to get Medicare Supplemental Policies. Asides from the basic plan A and B, which all insurance companies are required to offer, other Medigap plans customers can purchase from Americo Financial Life, And Annuity Insurance Company include plans F, G, and N.

Purchasing a Medigap plan from Americo is easy and swift; the insurance company also charges no application fee. Customers can get a reasonable household discount of 10% if they reside with someone above the age of 60. Americo Medicare Supplemental Plans also come with affordable premiums and competitive rates.

For a customer to qualify for any of the Medigap plans offered by Americo Financial Life and Annuity Insurance, they must be aged 65 years or older, and not enrolled in a Medicare Advantage Plan. Potential customers below age 65 with End-Stage Renal Disease or disability are also eligible to purchase a Medicare Supplement insurance policy.

It is possible to get a household discount on any of the Medigap plans provided by Americo if a customer lives with another adult over age 60.

Prices range depending on age, location, and benefits. On average, a Plan G is between $100-$150 per month. For exact costs please contact us at 800-208-4974.

Americo Medicare Supplement Plan F

Medicare supplement Plan F provided by Americo offers the most comprehensive coverage of all the plans sold by the company. This plan includes all the benefits of plan C and covers Plan B excess charges. Plan F is only available to applicants eligible for Medicare before 2020.

Customers on Plan F with a high deductible are required to pay for deductibles, coinsurance, and copays up to the deductible amount of $2,340.

Also, with plan F, there are no Copays, no out-of-pocket costs, and no deductibles. In other words, Plan F covers the gap if a customer’s Medicare plan A or B pays a penny on any hospital or doctor charges. Other benefits of Medigap plan F includes the following:

- Foreign travel emergency (80% up to lifetime maximum).

- Skilled nursing and hospice care.

- First three pints of blood per year.

Americo Medicare Supplement Plan G

Medigap plan G is an affordable plan that covers the customer’s share of any medical benefit covered by Original Medicare. However, plan G does not provide coverage for plan B deductible. Customers on this plan do not have to pay medical expenses that are normally paid out of pocket. Benefits of Medicare supplement plan G include:

- Skilled nursing and hospice care.

- First three pints of blood per year.

- Inpatient hospital costs.

Americo Medicare Supplement Plan N

Medigap plan N is the newest plan introduced to the world of Medicare supplements, and this plan is one of the plans offered by Americo Financial Life and Annuity. Plan N covers the entire plan A deductible and plan B coinsurance after the beneficiary’s annual deductible is met.

Americo’s plan N also covers 20% of expenses and copays for outpatient hospital services but leaves out copayment of up to $20 for some office visits and up to $50 copayments for emergency room visits that do not result in an inpatient admission. Under this plan, Part B deductible and excess charges are not covered. Other benefits of Medigap N include:

- Skilled nursing and hospice care.

- Foreign travel emergency (80% up to lifetime maximum)

- First three pints of blood per year.

Filing a claim with Americo

Americo claims are filed electronically and directed towards the administrative offices after Medicare approves them. Customers can request electronic claims forms using either the email address, phone numbers, or fax numbers available on Americo’s website.

The Best Medicare Plans: Plan F vs Plan G vs Plan N

While Medicare plan A and B provide a long list of coverages, several out-of-pocket expenses such as coinsurance, copayments, and deductibles are left out. Medicare supplement plans or Medigap can help a great deal by providing coverage for some of these costs. Americo Medigap plan G and plan F provide the most comprehensive coverage for out-of-pocket expenses, with added benefits such as emergency healthcare received from the United States and skilled nursing and hospice care coinsurance.

Out of all Medigap plans offered by Americo, plan F covers the most gap in Medicare insurance. Although its rates surpass other plans, Plan F leaves out none of the benefits available under Medicare insurance. Plan G is the closest to plan F offering almost the same broad coverage as the latter except the Part B deductible. Plan N comes next because it offers similar benefits, except excess charges, and copayments for doctors and E.R visits are left to be handled by the policy beneficiary. All three plans come with merits and demerits. Therefore, it is best to consider the type of coverage more useful in the long run.

Our Expert Recommendations

Americo Financial Life and Annuity Insurance Company is a reliable Medicare supplement provider with excellent financial strength. Americo Life has fair rates on plan F and G, but their premium is not the best on the market. Nonetheless, intending customers can consider perks such as the 10% household discount, no policy fee and easy application process provided by Americo.

thumb

For a free quote comparison between Americo Life and other Medicare supplement providers, please call us at (800) 208-4974.

Continue Reading:

- Gerber Life Medicare Supplement Review

- Reserve National Medigap Plans

- Thrivent Medicare Supplement Plans

Share This: