We are proud to offer Mutual Of Omaha as one of our trusted carriers. If you are looking for a free comparison contact us directly at (800) 208-4974 or apply directly online here.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

Carrier Background

Mutual Of Omaha Insurance Company was chartered in 1909 and offers a wide range of individual and group health and accident products across the country.

Mutual Of Omaha offers Medicare supplement plans A, F, G and N depending on the state you are in. Plans A and F are offered in ALL states. MOO is a mutual company and its subsidiaries include:

- United Of Omaha Life Insurance Company

- Companion Life Insurance Company

- United World Life Company

- Omaha Insurance Company

- Mutual Of Omaha Investors Services

- Omaha Financial Holdings

When you purchase a Medicare Supplement plan with Mutual of Omaha you get the following benefits:

- Portable Coverage

- Ability to see any doctor that accepts Medicare

- Guaranteed renewable coverage for life

- 30 Day free look period

- No policy fee

- 12% household discount (where available)

- Initial 12-month rate lock-in

- Foreign travel emergency coverage

Highlights with Mutual Of Omaha Medigap Policy:

- Easy electronic application

- Policies issued the same day (in most cases)

- Email delivery of temporary ID cards

- A convenient online portal to view EOB benefits

- Top-rated customer service and claims handling

Mutual Of Omaha Medicare Supplement Plan F

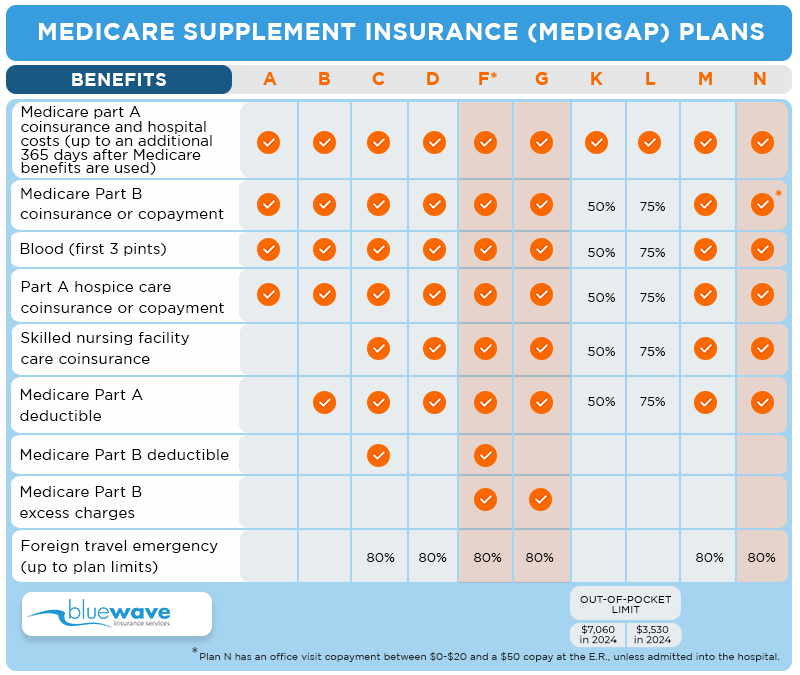

Plan F is offered by Mutual Of Omaha, either direct or by one of their subsidiary companies. Because Plan F is a standardized Medigap plan, it is exactly the same no matter what company is offering it.

Plan F covers 100% of what Medicare does not pay in full; it is the most comprehensive Medigap plan available. Also, it is the most expensive premium wise.

We always recommend Plan G vs Plan F for reasons outlined here. See the chart below that shows what each Medigap plan covers.

Mutual Of Omaha Plan G

The Mutual Of Omaha Plan G is a very popular plan across the nation. Folks who purchase a Mutual Of Omaha Plan G pay a low monthly premium and have a fixed, annual deductible at the doctor’s office. The deductible on Plan G is $240 for 2024. There are no copays with Plan G when you visit the doctor or specialist.

The chart above outlines the coverage between the most popular Medigap plans, F, G, and N. You will notice that the only difference between F and G is that the Part B deductible is not covered on Plan G. Other than that, there are no differences in coverage.

Top Reasons To Buy A Plan G From Mutual Of Omaha:

- Limited out-of-pocket costs of $240 in 2024

- Plan F may be unavailable for some folks.

View Plans Online

Compare rates online instantly.

Mutual of Omaha Medicare Supplement Plan G Reviews

Medicare Plan G remains one of the top Medigap plans in the country. We have many clients that are extremely satisfied with their supplemental plan from Mutual of Omaha. Plan G provides 100% coverage for all the “gaps” left over by Original Medicare (except for the Part B deductible). The Medicare Part B coinsurance is covered in full.

As with all companies, rates will go up over time. Mutual is no exception to this rule.

Mutual Of Omaha Medicare Supplement Plan N

Plan N is the 3rd most popular Medigap plan and is offered by MOO. N is similar to G as it has the $240 annual deductible. Also, N has an office copay up to $20, $50 E.R. copay (waived if admitted), and Part B excess charges are not covered. (Excess charges can be easily avoided if you make sure the doctor is set up with “Medicare assignment”).

Read more: Part B Excess Charges

Plan N can be a great option for someone who doesn’t mind the office copays and wants to enjoy a lower premium than G or N.

Mutual Of Omaha Medicare Supplement Plans in 2023

Mutual Of Omaha will continue to offer Medigap plans in 2023. Plan F will no longer be offered to people who are turning 65 after January 1st, 2020. Folks who currently have a Plan F can keep it indefinitely, or they can change to a Plan G or N for a reduced premium.

Those people who were eligible for Medicare prior to Jan. 1st 2020 can still purchase a Plan F.

Mutual of Omaha Medicare Supplement Rates

There are many factors that affect the price of your policy such as age, location, and gender. Here are some sample rates for a female age 65, non-tobacco in Dallas, Texas:

| Plan A | $113 per month |

| Plan F | $162 per month |

| Plan G | $119 per month |

| High Deductible G | $44 per month |

| Plan N | $96 per month |

Agent Tip

View personalized, custom quotes online instantly here.

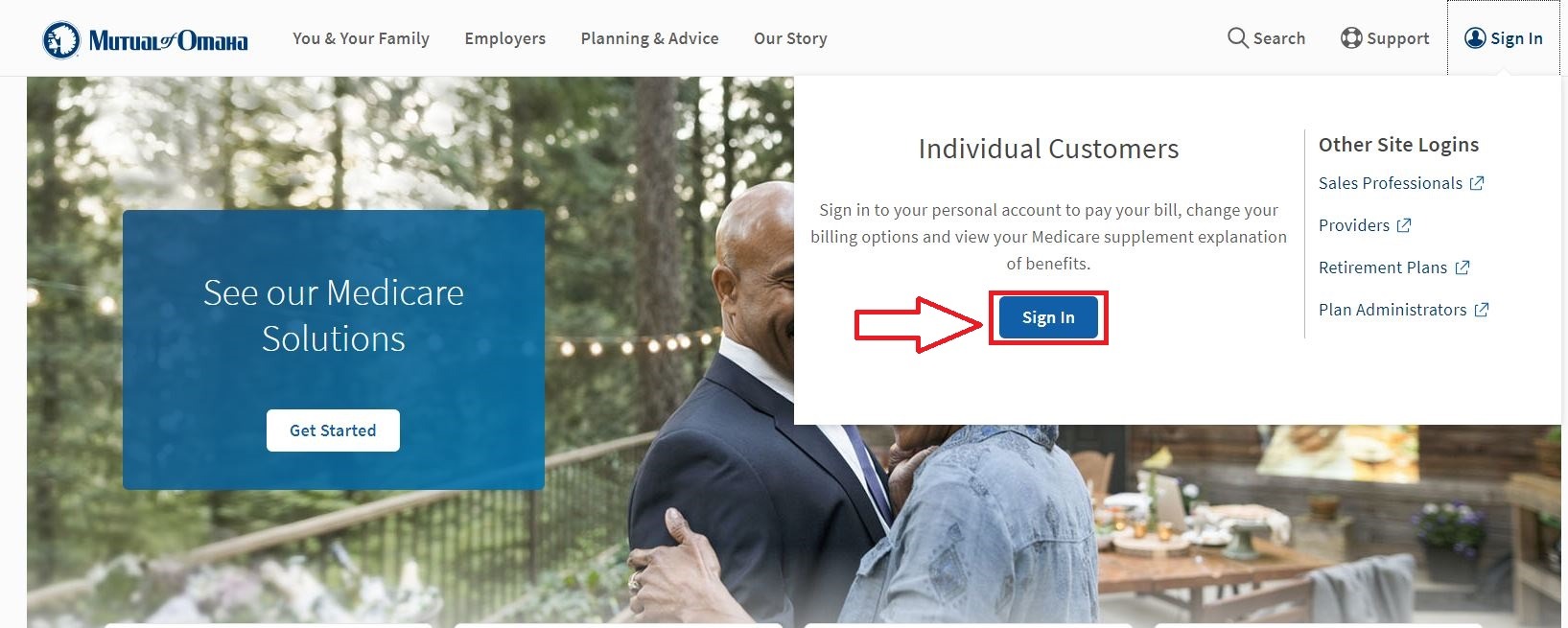

Easy To Use Online Policyholder Portal

Mutual Of Omaha has one of the best online portals. Once your policy is issued you can register for an account online. Our clients find this extremely easy to use. Among other things, you will have the ability to view your explanation of benefits (EOB) online was your claims are processed. This can save you a lot of time, you won’t have to wait on hold with customer service just to order a new ID card or to pay a bill.

With the online portal you can do the following:

- Get Your Current Account Summary

- Review Your Policy Benefits and Claims Info

- Pay Bills Online

- Get a Duplicate ID Card or Policy

Common Client Questions

Yes, Mutual Of Omaha is a great option for your health insurance, a solid company with excellent customer service.

Mutual Of Omaha does have a dental plan option. The cost varies depending on where you live. This would be a separate policy from your Medicare supplement.

In most states, a vision benefit is included in your Medigap plan. This will cover basic things. Call us for any questions on this coverage.

In some states you will get a hearing discount program included with your supplement policy from Mutual of Omaha.

Part D is offered by Mutual in most states. Part D is separate from your Medigap plan and covers the prescriptions you get at the pharmacy. A separate premium is paid for Part D.

In most states, you can add a gym benefit to your Mutual of Omaha Medigap plan. The benefit is referred to as “Mutually Well.” It is an additional $25 per month and allows you to access over 10,000 gyms.

Our Professional Opinion

Our Mutual Of Omaha Medicare supplement review is overall a strong recommendation. The Medicare Plan G is the most popular plan offered by Mutual, mostly because there are no office visit copays to worry about.

A winning combination of stability and excellent customer service makes MOO a great option for your Medicare supplement insurance. The ability to receive ID cards and policies via email and through regular mail is a great feature that our clients love. In addition, Mutual Of Omaha boasts solid financial backing and great brand recognition among consumers.

For assistance, simply call us direct at (800) 208-4974, or you can APPLY ONLINE HERE. We would be happy to help you with your decision.

We are a unique insurance agency dedicated to assisting folks with Medicare. Learn how we are different here.

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.