If you are currently covered by Medicare you have likely received some information about the Medicare Open Enrollment Period, or OEP. Starting with the plan year of 2022, there are some changes taking place with the Medicare Open Enrollment Period.

It is important to be aware of some key dates and to know what you can and cannot do with your Medicare coverage during this time.

What is the Open Enrollment Period?

The OEP runs from January 1st – March 31st, 2022. During the Medicare Open Enrollment Period, those who are eligible for Medicare have the opportunity to enroll and/or to make various changes to their Medicare coverage. For instance, during the Open Enrollment Period for Medicare, you can:

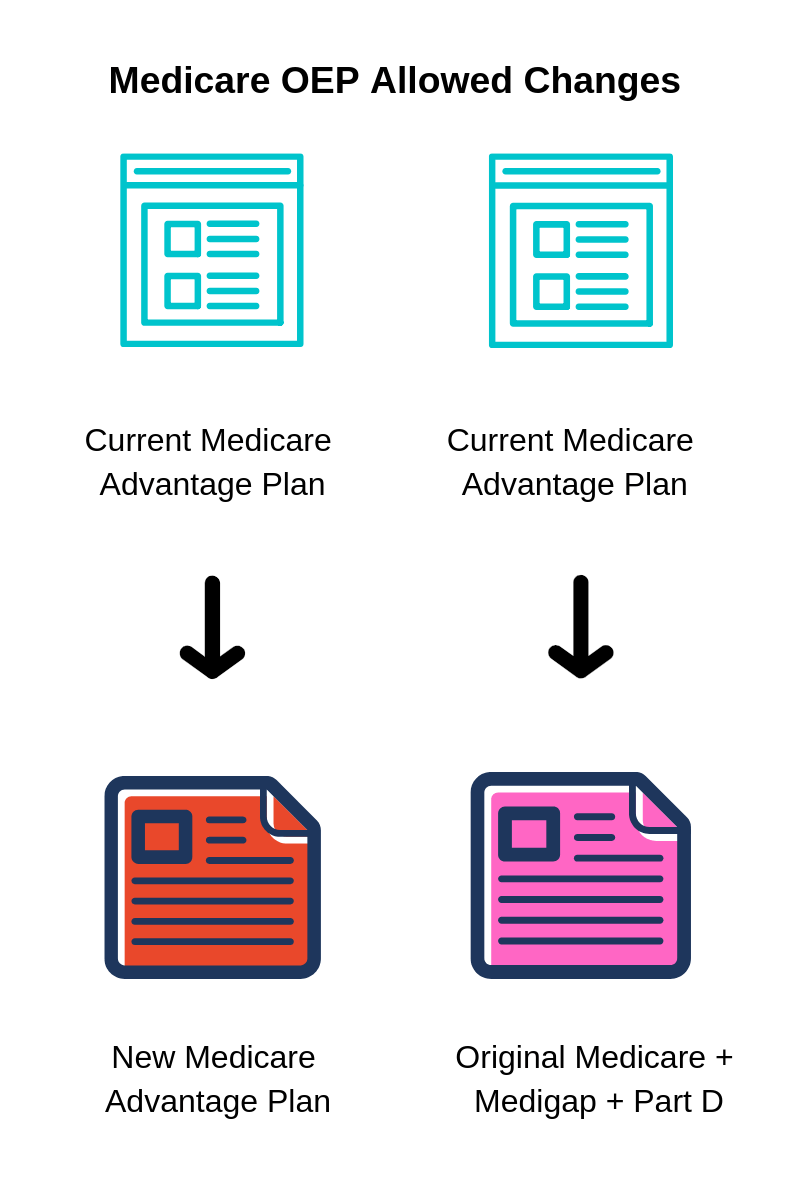

- Move from a Medicare Advantage plan (Medicare Part C) back over to Medicare Part A and B (which is also known as Original Medicare)

- Switch from one Medicare Advantage plan to another Medicare Advantage plan.

The Medicare Open Enrollment Period (OEP) differs from the Annual Enrollment Period (AEP). The AEP is the annual Medicare Advantage and Medicare Part D prescription drug plan enrollment period. During this time, which runs from October 15th through December 7th each year, Medicare enrollees can change, add, or drop Medicare Advantage coverage or their Medicare Part D drug plan. If you do so, your new coverage will begin on the following January 1st.

Being able to make such changes is beneficial for Medicare participants because Medicare health and drug plans can – and often do – make revisions and updates to their coverage, their costs, and/or to their provider networks.

For the 2022 Medicare plan year, there are some changes taking place regarding what you can do, as well as the time frame in which you have to do it.

What Changes Can Be Made During the Open Enrollment Period?

During the 2022 plan Open Enrollment Period for Medicare, you can make one plan change during the allotted time period. This means that if you are currently enrolled in a Medicare Advantage plan, you can either change to a different Medicare Advantage plan, or you can change your coverage back over to Medicare Part A and Part B between January 1st, 2022 and March 31st, 2022.

Within the first quarter of 2022, you may also enroll in stand-alone Medicare Part D prescription drug coverage – but only provided that you are making a switch from a Medicare Advantage plan back over to Original Medicare.

What Changes Cannot Be Made?

While the 2022 Medicare Open Enrollment Period changes can provide you with some added flexibility, it is important to be mindful of what you are not allowed to do during this period of time. In this case, you may not change from one Medicare Part D prescription drug plan to another during the January 1st to March 31st time period.

So, if you want to make a switch from one stand-alone Part D plan to another, this will have to take place during the fall (October 15th to December 7th) Medicare Open Enrollment Period.

Why is OEP Important?

The Medicare Open Enrollment Period (OEP) is important for several reasons. First, if you are currently enrolled in a Medicare plan that does not fit your needs, it is during this time frame that you can switch to an option that more closely matches your coverage requirements.

In addition, the ability to switch from a Medicare Advantage plan back to Original Medicare coverage can also provide you with much more flexibility in terms of your benefits – particularly because there are no networks or requirements to use specific providers.

How to Ensure that You Don’t Miss Out on Getting Your Medicare Coverage

In order to ensure that you get your Medicare coverage in place, it is important to know which of the available options will work the best for you and to then enroll and/or make changes within the allotted time frame.

While the Medicare enrollment details may seem a bit overwhelming, the good news is that there are experts available who can help to walk you through the process, and who can also answer any questions that you may have.

We Are Here To Help

At Bluewave Insurance, we specialize in helping individuals and couples with securing the right Medicare coverage – and, because we are an independent agency, we can provide you with quotes from many of the top-rated providers.

So, if you still have questions about how to enroll in Medicare, or you would like to compare quotes on available Medicare plans, contact us today at (800) 208-4974.

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.