We are proud to offer Loyal American Insurance Company as one of our trusted carriers for Medicare Supplement plans. For a free quote, call us directly at (800) 208-4974.

Loyal American Life Insurance Company History & Overview

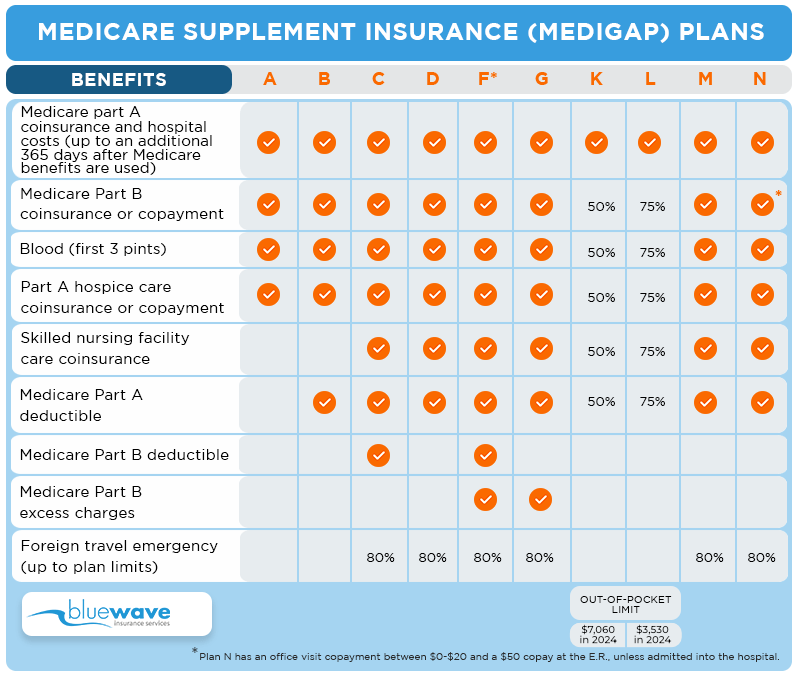

Medicare Supplement insurance is designed to supplement Original Medicare and pay the “gaps” leftover that Medicare does not cover (like copayments, coinsurance, and deductibles).

Generally, Medicare will pay its share of the Medicare-approved amounts for covered health care costs and your Medicare Supplement insurance will pay its share.

One of the top Medicare Supplement companies is Loyal American Life Insurance Company. Loyal American is a subsidiary of Cigna. They are headquartered in Austin, Texas, and have been offering insurance products since 1955.

Loyal American Medigap Rating

Loyal American maintains a B++ rating with A.M.s Best. This rating is due to the fact that Loyal American maintains a steady financial stream and has shown outstanding performance over the years. Loyal American offers Medicare Supplement plans F, G & N. Prices vary depending on several factors such as age, location, and coverage.

Medicare Supplement Plans Offered By Loyal American

Loyal American currently offers Medicare Plans F, G, N, and more. A Medicare Supplement plan with Loyal American comes with the following features:

- 30-day free look period

- Guaranteed renewable for life

- Portable coverage

- 12-month rate lock-in

Loyal American offers a wide variety of Medigap plans that span from Plan A, Plan F, Plan G, and Plan N. Although each plan has a different rate and coverage level, it overall helps you reduce out-of-pocket costs that Original Medicare doesn’t cover. Depending on the plan you get, a Medigap plan can help cover the cost of inpatient and outpatient care.

In order to be eligible for Loyal American Medicare supplement plans, you must be entitled to Medicare Parts A or Part B. In addition, folks can sign up during the Initial Enrollment Period, which happens six months after their Part B effective date.

Loyal American Medicare Supplement Plan F

Plan F is the most comprehensive policy option for Medicare beneficiaries. Loyal American Plan F covers 100% of all costs that are leftover after Medicare pays its share. Medicare Plan F covers the Part A and B deductibles, excess charges, and all office visit copayments.

Loyal American offers Plan F in every state they are licensed in. Plan F tends to be a bit more expensive than Plan G and generally has higher rate increases. For most folks, Plan G will be more cost-effective.

Loyal American Medicare Supplement Plan G

G is currently the most popular plan offered by Loyal American. All Medicare Supplement plans are standardized, Plan G is exactly the same, no matter what company is offering it. As shown in the chart above; Plan G covers 100% of all major costs Medicare does not pay.

Some coverage advantages of Plan G:

- Part B excess charges

- Medicare Part A deductible

- Hospice care coverage

- Foreign Travel benefit

Agent Tip

The only benefit that is not covered in the Part B deductible, which is currently $240 in 2024. Plan G is often a much better value than Plan F for the reasons outlined here.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

Loyal American Supplemental Plan N

Loyal American offers Plan N as one of their popular supplemental plans. Plan N has a copay of up to $20 at an office visit, $50 copay at the E.R.

Part B deductible of $240 and Part B excess charges are not covered.

Here are some coverage highlights of Plan N:

- Skilled nursing services

- 80% foreign travel expenses

- Blood (first 3 pints)

Plan N offers a lower premium vs plans F and G but has more out-of-pocket costs.

Read More: Plan N vs Plan G

Our Professional Review

As a subsidiary of Cigna, Loyal American enjoys all the same financial ratings, name recognition and great customer service you get with a Cigna product.

The rates are very competitive across the country for plan F, G, and N. If you purchase a Medicare Supplement plan with Loyal American your ID card and policy will say “Cigna” in big lettering on the front as well as the “Loyal American.”

thumb

With strong financial backing and competitive rates; we are pleased to recommend Loyal American to our clients. For a free, rate comparison call us directly at (800) 208-4974.

Loyal American Medicare Supplement Plans

-

Competitive Rates

-

Rate Stability

Get A Free Quote!

Contact us today at (800) 208-4974 for a free quote comparison.

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.