At Bluewave Insurance we are proud to present our clients with Equitable Life Medicare supplement plans. If you are interested or would like to learn more, give us a call at 800-208-4974.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

Equitable Life Company Overview

Active for over 80 years and offering top quality health insurance plans, coupled with a friendly, customized, and advanced service to consumers nationwide, Equitable Life & Casualty Medicare is a leader in the Medicare Supplement market.

Established in 1935, based on the principles of equality and fairness, Equitable Life and Casualty has enjoyed several decades of success. The insurance company offers prompt, professional and personal service and a flexible range of Medicare supplement plans via an easy application process to confirm acceptance.

Equitable Life Additional Insurance Products and Rating

The company’s portfolio includes Medicare supplement plans, whole-life insurance plans, hospital indemnity, critical illness insurance, and short-term nursing home coverage.

Equitable Life currently has a B+ (Good) rating from A.M. Best, meaning they are showing great financial stability and have been able to satisfy their stakeholders and policyholders year after year.

Equitable Life insurance company is currently available in 45 states plus the District of Columbia. Since rates vary state by state, we advise folks to contact a licensed insurance agent to compare rates and find the best plan for their needs.

Some of the reasons why Medicare-eligible folks pick Equitable Life for their Medicare supplement plans is because they offer guaranteed renewal, premium protection, portable coverage, and household discounts.

Equitable Life Medicare Supplement Benefits and Options

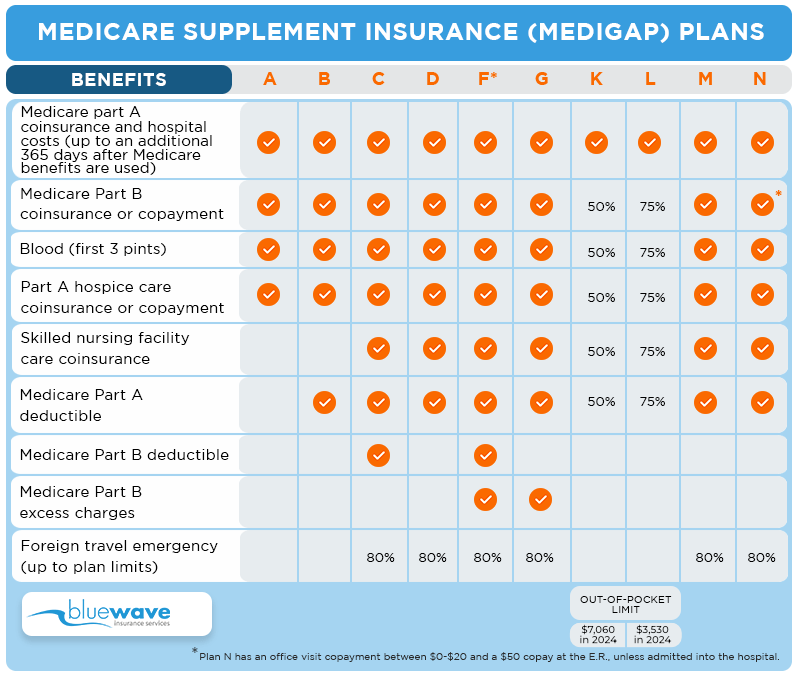

Depending on the geographic area Equitable Life and Casualty offers Medicare Supplement plans F, G and N. The premiums for the three plans differ in accordance with the geographic area and age, along with other factors.

In 2018, Equitable starting insuring their plans under the subsidiary “Equitable National Life Insurance Company.”

All plans with Equitable Life and Casualty feature the following:

- Portable coverage

- Guaranteed renewable for life

- 12-month rate lock-in

- Unlimited lifetime benefit

Equitable Medicare Supplement Plan F

Plan F is simple; it covers 100% of all costs that Medicare does not cover in full. As you can see in the chart above, Plan F pays all costs. With a Plan F, you will generally pay more in premium each month and not have any hospital or doctor bills. Equitable is generally competitive on price in most areas for Plan F.

Equitable Medicare Supplement Plan G

Plan G is the most popular plan that Equitable offers. We recommend Plan G because it provides the most value vs Plan F, for reasons explained here. On average, Plan G offers more rate stability than Plan F.

The only benefit difference between F and G is an annual deductible of $240 per year on Plan G. This is the Part B deductible and is associated with doctor visits and outpatient services. The premium difference between Plan F and G is often $300+ per year. For example; $300 – $240 = $117 in net savings on Plan G, plus better long-term rate stability.

Equitable Medicare Supplement Plan N

Plan N is the third most popular plan offered by Equitable Life and Casualty. Plan N comes with more out-of-pocket costs than Plan F and G. This can be a more affordable solution for those looking to save money on premiums. The out-of-pocket costs associated with Plan N are:

- $0-$20 co-pay at an office visit

- $240 annual deductible in 2024

- Part B excess charges not covered

- $50 copay at the E.R. (waived if admitted)

Our Review

Equitable Life and Casualty is an old name in the insurance business. They have been around for quite a long time. Overall we do recommend their policies under “Equitable National Life.” We like them for the following reasons:

- Easy underwriting when changing policies

- Fast policy issue

- Competitive rates

- No hassle customer service

We work with about 30 different insurance companies, specializing in Medicare supplement plans.

thumb

If you have general questions or simply want to compare plans and prices, give us a call at (800) 208-4974. To learn about potential other carriers see our full list of company reviews.

Equitable Life and Causality Review

-

Competitive Rates

-

Rate Stability

-

Market Experience

Review

Contact us at (800) 208-4974 for a free Medciare supplement quote.

Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.