Bluewave Insurance is proud to offer Lumico as one of our trusted carriers. Call us for a free quote comparison at 800-208-4974.

Company History and Background

Lumico Life is a leading provider of Life and Medicare supplement insurance plans for Medicare beneficiaries. The company, formerly known as Lumico Life Insurance, has been in business for over 50 years and is partnered with Swiss Re, one of the world’s largest reinsurance companies.

Are you considering getting medical supplement insurance through Lumico? Find out what plans are available for you in this article or call us directly at (800) 208-4974.

Financial Strength and Ratings

Lumico has earned an “A” (Excellent) rating for its financial strength by A.M Best Rating Services, its second-highest rating, indicating the company is financially stable and secure. It also scored an “A+” long-term issuer credit rating.

A.M Best’s report also described the company’s balance sheets as very strong. Lumico receives reinsurance support from its parent company, Swiss Re.

Lumico Medicare Insurance Products

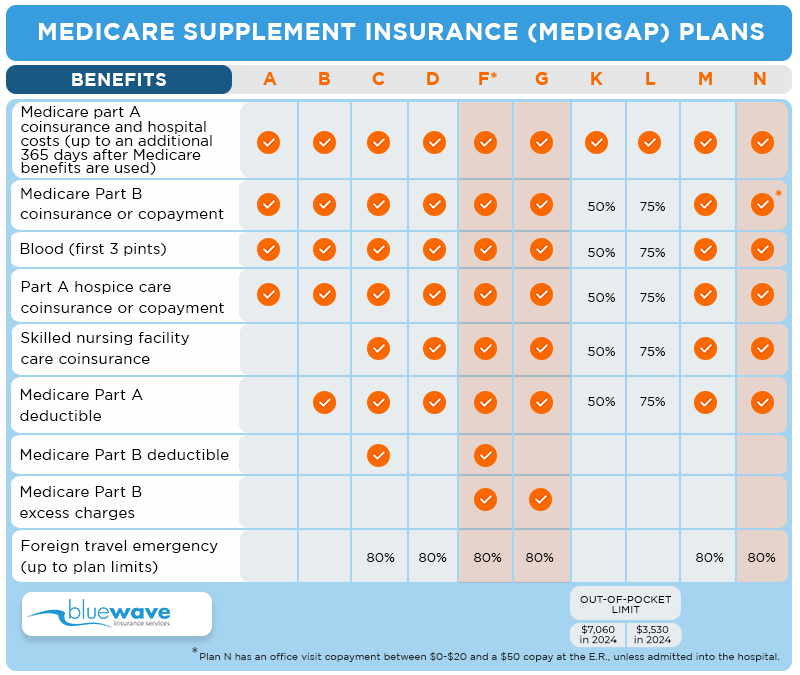

Lumico’s Medicare insurance (aka “Medigap”) plans are popular amongst individuals aged 65 and older across the country, enabling them to obtain medical supplements at competitive rates. Medigap plans are standardized by the government to ensure that individuals receive the same essential health benefits, regardless of the insurance company they choose.

This article better explains how pricing works with Medigap plans.

Lumico’s Medigap plans are guaranteed renewable for life. They are ideal for Medicare beneficiaries who want to secure additional coverage for expenses such as coinsurance or deductibles.

Lumico offers the following Medicare supplement plans:

Lumico Medicare Supplement Plan F

Medicare supplement Plan F is the most comprehensive plan Lumico offers. All Medicare-approved providers across the country accept Lumico Plan F. Compared to Plans G and N, it is the most costly option available.

Lumico Medicare Supplement Plan F covers 100% of Part A coinsurance and hospital costs for up to 365 days after you have used up your initial Medicare benefits. Plan F also provides coverage for the following:

- Blood coverage (first 3 pints)

- Part A hospice coinsurance/copayment

- Part B coinsurance

Additionally, Plan F also covers 100% of excess charges on Medicare Part B benefits and 80% of the cost of foreign travel emergencies (up to $50K).

Agent Tip

Plan F is not available for purchase for people who turned 65 or started Medicare Part A after January 1st 2020.

Lumico Medicare Supplement Plan G

Medicare plan G is one of the most comprehensive and popular Medicare plans Lumico offers. It is also one of the most affordable, allowing customers to bypass costs that they would typically pay out of pocket with Original Medicare.

Lumico Supplement Plan G highlights:

- Part A coinsurance

- 1-year (365 days) in-patient hospital care

- Blood coverage (first 3 pints)

- Part B coinsurance

The Plan also provides skilled nursing facility care coinsurance, 80% of foreign medical emergency costs (up to $50K), and Part B excess charges. People who purchase Plan G need to pay the Part B deductible once a year, in return for paying the deductible, they enjoy a lower premium.

Agent Tip

The Part B deductible in 2024 is $240. This deductible is associated with doctor visits and Part B outpatient services.

Which Plan is Better? Plan G or Plan F

The main distinction between Plans F and G is that the former covers the Part B deductible once per year while the latter doesn’t.

The premium offered by these plans may vary from state to state, but the benefits are the same across the board.

With plan F, you avoid paying out of pocket for hospital bills or anything covered by Medicare Part A & B.

Keep Reading: A more comprehensive look at Medicare Plans F and G.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

Lumico Medicare Supplement Plan N

Another medicare supplement plan worth considering is Medicare Plan N. This Plan is ideal for individuals that don’t visit the hospital very often. With a Plan N, you are responsible for an office visit copay (up to $20), ER room visits (up to $50), and the Medicare Part B deductible is not covered.

Additionally, Plan N provides blood coverage for up to 3 pints of blood per year and hospitalization costs for the first 61-90 days within each Medicare benefit period and day 91-150 once in your life. It also covers the cost of outpatient prescription drugs, coinsurance for outpatient respite care, and 80% of the cost of foreign travel emergencies (up to $50K).

Which Plan is Best? F, G or N?

All three plans offer great benefits for your medical supplement insurance – it all boils down to how frequently you visit the hospital and, of course, your budget. Plan F covers the Medicare Part B deductible while Plan G and N do not.

Plan G is the most popular Plan, followed by Plan N.

For a free quote comparision, call us at (800) 208-4974

Our Professional Advice

In our opinion, Lumico is a reliable option for your Medicare Supplement insurance company. Based on the financial strength and competitive rates.

The company offers some of the lowest rates on supplement plans in the country. It aims to simplify the registration process for its customers, including an electronic application.

Call us at (800) 208-4974 for a FREE quote comparison for your Medicare Supplement coverage!

Continue Reading:

Aetna Medicare Supplement Review

Cigna Medigap Plans

Thrivent Medicare Supplement Plans

Share This: