At Bluewave Insurance we are proud to present our clients with Guarantee Trust Life Medicare supplement products (GTL). To learn more call us at 800-208-4974.

Compare Medicare Supplement quotes from the Nation's top rated carriers for Free

Call us at 800-208-4974 or enter your details below for instant access

Guarantee Trust Life Company History and Overview

For more than 80 years Guarantee Trust has been providing top-notch insurance products for policyholders around the United States. Their mission is to provide people access to health care products that will suit their needs. In addition to providing some of the best Medicare supplement products in the market today, they also provide other insurance products such as:

- Hospital Indemnity

- Precision Care Cancer Insurance

- iGAP – Guaranteed Issue Accident Insurance

- Group Accident

- Short Term Care

- Senior Dental

This is just a shortlist of their health insurance products, to learn more about Guarantee Trust Life and their Medicare supplement products, or for a free quote comparison, contact us at 800-208-4974 to speak with an experienced insurance agent.

Guarantee Trust Life Financial Strengths and Rates

From their last rating from A.M. Best, Guarantee Trust Life received a A- (Excellent) rating. That was after their BBB+ rating the past year. This means that they are demonstrating healthy balance sheets, predictable revenues, and they are performing well for their stakeholders and cliental. To have such a rating in the Medicare supplement industry is difficult to get, so Guarantee Trust Life insurance really put in the work in their products and services.

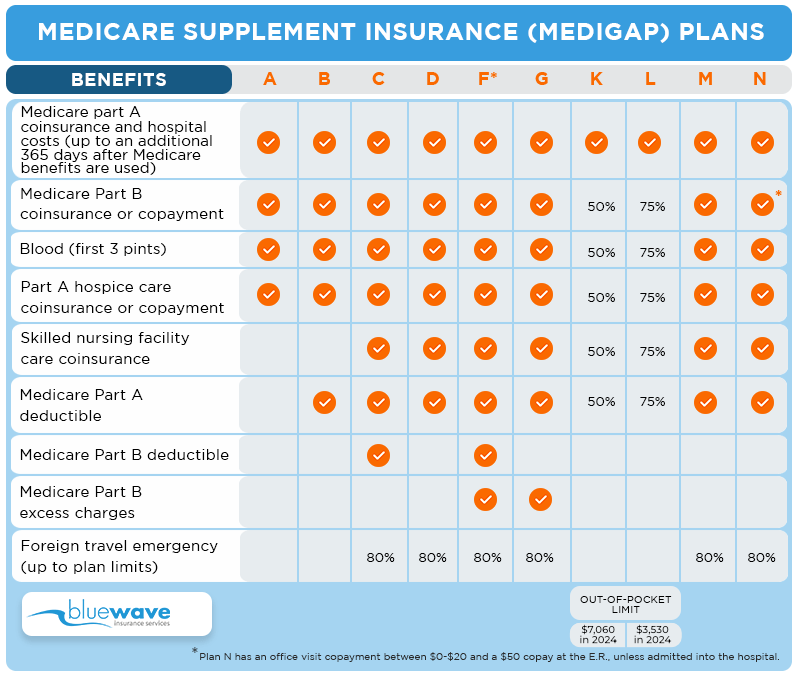

Guarantee Trust Life Insurance Company Medigap Products

When you turn the age of 65 or older you are eligible to sign up for Medicare. The US government created the plans which cover 80% of your medical cost, there is still that 20% that is not covered. That’s where having a Guarantee Trust Life Medicare supplement plan comes in handy.

GTL currently offers Medicare supplement plans to 49 states plus the District of Columbia. With their comprehensive supplement plans, you will be able to fill the “gap” that Original Medicare doesn’t cover. Depending on your needs you’ll have the freedom to choose from Plans A, F, G, and N.

This article will elaborate more on those plans. If you have any questions about the benefits of a Medicare supplement plan or if Guarantee Life might be the provider for you, give us a call at 800-208-4974, our trusted insurance would be happy to assist you.

Yes, with Guarantee Trust Life Medicare supplement plan you are able to choose your own doctor and the specialist, physician, or health care professional you need. This makes it very convenient for you to go to medicare professionals you trust.

Yes, if you are enrolled into Guarantee Trust Life there is guaranteed renewability for life. This means that if you keep paying your Medicare supplement policy premiums on time, your plan will never be canceled. If you would like to learn more about Guaranteed Trust Life Medicare supplement plans contact Bluewave Insurance at 800-208-4974.

Guarantee Trust Life Medicare Supplement Insurance Policy Plan A

Don’t confuse Medicare supplement Plan A with Original Medicare Part A, they are both very different coverage plans. Plan A, however, is probably the most basic out of the four available Medicare supplement plans by GTL. This is a very lean plan that covers the least benefits, but still has a great impact to reduce out of pocket costs.

With Plan A it is guaranteed to cover 100% of these four things:

- Part A inpatient hospital care coinsurance

- Part B copay

- First 3 pints of blood

- Part A hospice care

Depending on your health, lifestyle, or unique situation, you may need minimal coverage, so Plan A may be for you. If you have any questions on Part A or any other Medicare supplement plan, contact our experienced insurance team at 800-208-4974. We would be happy to speak with you and answer any questions.

Guarantee Trust Medicare Supplement Plan F

Plan F is one of the most comprehensive Medicare supplement plans out on the market today. If you become eligible for Medicare prior to January 1st, 2020 then you are still eligible to purchase Plan F.

Here are some of the costs that Plan F covers so you don’t have to pay out of pocket:

- Part A deductible

- Part B excess charges

- Part B deductible

- Hospital and coinsurance

- Skilled nursing facility

- Hospice care

If you have any questions about Medicare supplement Plan F or would like to know more about Medigap, contact us at 800-208-4974. Our experienced insurance agents would be happy to help you.

Compare Plans Online

Receive a Free Quote Instantly!

Guarantee Trust Medigap Plan G

Medicare Supplement Plan G is pretty much the same as Plan F, except it does not include the Part B deductible which must be paid-out-of-pocket. Once your Part B deductible is all paid off, then you only have to pay 20% of the Medicare-approved services.

In addition to covering Part B excess charges, Plan G also has all the basic benefits. Here are some of the highlights of why seniors choose Plan G as their Medicare supplement plan:

- Part A hospital coinsurance

- Hospital cost after 365 dates after of Original Medicare

- Part A deductible

- Foreign travel medical care (limited)

- First 3 pints of blood

- Preventative care

If you missed the opportunity to sign up for Plan F, then Plan G may be the plan for you. It has to most comprehensive coverage benefits out of all the Medicare supplement plans. At Bluewave insurance, we believe that this is the best plan for folks. If you have any questions or would like to know how Plan G can help you, contact us at 800-208-4974 and one of our insurance agents would be delighted to help you.

Guarantee Trust Medicare Supplemental Insurance Plan N

Guarantee Trust Life also has Medigap Plan N, even though this is a standardized Medicare supplement plan, rates may vary depending on the state you live in, age, and if you are a smoker and nonsmoker. In those cases, even though the benefits are the same throughout the U.S. it’s best to compare rates.

The only drawback with Plan N is that it requires policy holders to pay $20 for each doctors visit, $50 for emergency room visits. It does cover all of the Medicare Part B coinsurance.

Here are some of the benefits of Plan N:

- Part A deductible

- Skilled nursing facility

- Preventative care

- Hospice Care

Plan N may be the plan for you if you want a coverage plan at a lower price. However, it may not be the best if you frequent a doctor’s office or emergency room a lot. If you are having trouble choosing the right plan for you, give us a call at 800-208-4974 to figure out which Medicare supplement plan is best for you.

Our Final Thoughts on GTL Medicare Supplement Plans

Guarantee Trust Life offers incredible customer service and Medicare supplement products that will satisfy many seniors’ needs. However, choosing the right plan and carrier can be a daunting task for someone to do alone. We recommend that folks sign up for GTL because we believe in their mission and products.

thumb

If you don’t want to go through choosing a Medicare plans alone, and want unbiased opinion on making an educated decision, give us a call at 800-208-4974. Our team at Bluewave Insurance would be happy to answer any questions you may have.

Read More:

Share this on: